san francisco gross receipts tax ordinance

Neighborhood beautification and graffiti clean-up fund tax option. CELL PHONES PAGERS AND SIMILAR SOUND-PRODUCING ELECTRICAL DEVICES.

Taxes 2022 7 On Your Side United Way Answer Viewer Questions During Tax Chat Abc7 San Francisco

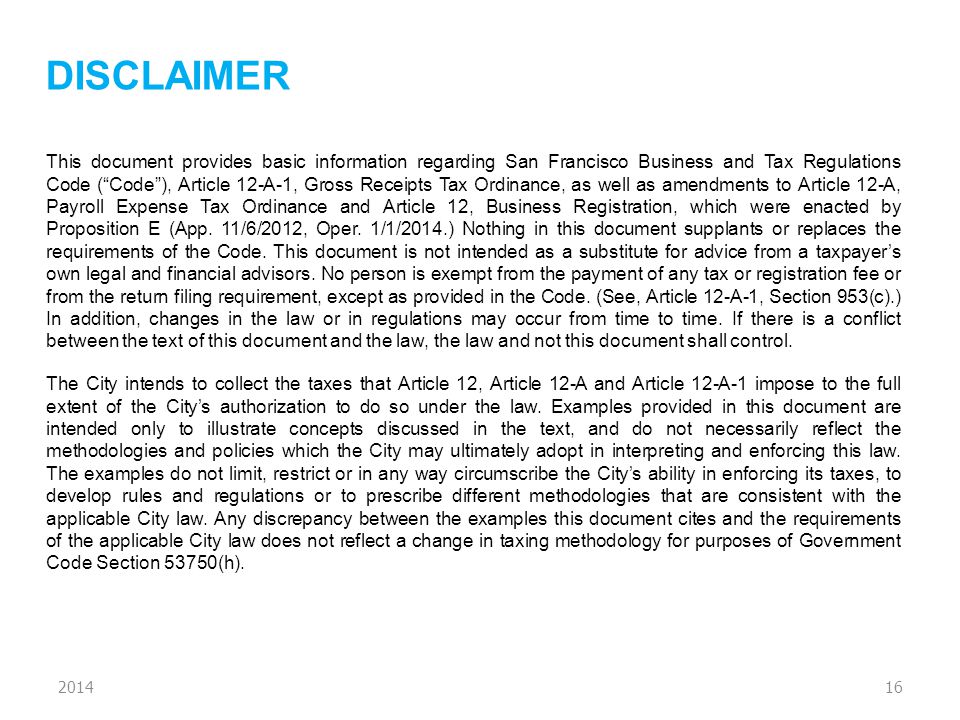

Consult your own tax professional attorney or Certified Public Accountant for specific information.

. City and County of San Francisco. 1 Proposition E San Francisco Gross Receipts Tax Ordinance Article 12-A-1 Gross Receipts Tax Ordinance approved by voters on November 6 2012. THE SAN FRANCISCO SUNSHINE ORDINANCE OF 1999.

CELL PHONES PAGERS AND SIMILAR SOUND-PRODUCING ELECTRICAL DEVICES. THE SAN FRANCISCO SUNSHINE ORDINANCE OF 1999. The Homelessness Gross Receipts Tax effective January 1 2019 imposes an additional gross receipts tax of 0175 to 069 on combined taxable gross receipts over 50 million.

1 on the amounts a business receives from the lease or sublease. The Gross Receipts Tax and Business Registration Fees Ordinance or simply Ordinance was approved by San Francisco voters on November 6 2012. Proposition F overhauls the citys gross receipts tax regime including increasing gross receipts tax rates for all businesses when the measure is fully implemented.

The approved ordinance also created the overpaid executive administrative office tax OEAOT to be imposed on San Francisco-based businesses including businesses with under 1 million. THE SAN FRANCISCO SUNSHINE ORDINANCE OF 1999. In November 2012 San Francisco voters passed Proposition E The Gross Receipts Tax and Business Registration Fees Ordinance the Gross Receipts Taxnbsp.

This includes ordinance interpretations and tax calculations of payment or fees. In November 2012 San Francisco voters passed Proposition E The Gross Receipts Tax and Business Registration Fees Ordinance the Gross Receipts Tax. Real property transfer tax.

CELL PHONES PAGERS AND SIMILAR SOUND-PRODUCING ELECTRICAL DEVICES. Mission Values Our Team Careers Request for Proposals Reports Plans COVID-19 Response News. Gross receipts tax ordinance.

CELL PHONES PAGERS AND SIMILAR SOUND-PRODUCING ELECTRICAL DEVICES. THE SAN FRANCISCO SUNSHINE ORDINANCE OF 1999. On June 5 2018 San Francisco voters passed Proposition C which imposes a new gross receipts tax of 1 percent on revenues a business receives from leasing warehouse space.

CELL PHONES PAGERS AND SIMILAR SOUND-PRODUCING ELECTRICAL DEVICES. Overpaid Executive Tax OE The Overpaid Executive Tax also referred to as the Overpaid Executive Gross Receipts Tax was approved by San Francisco voters on November 3 2020. 2 Gross Receipts Tax Ordinance.

THE SAN FRANCISCO SUNSHINE ORDINANCE OF 1999. In addition to the existing Gross Receipts and Payroll Expense Taxes this measure imposes a new gross receipts tax of.

2022 San Francisco Tax Deadlines

/GettyImages-1006671124-261d6a2f7ac8492295233351629b7305.jpg)

Introduction To Gross Receipts

Pdf Tax Pyramiding The Economic Consequences Of Gross Receipts Taxes Semantic Scholar

Gross Receipts Tax And Payroll Expense Tax Sfgov

Gross Receipts Tax And Business Registration Fees Ordinance Ppt Download

San Francisco Tax Update Deloitte Us

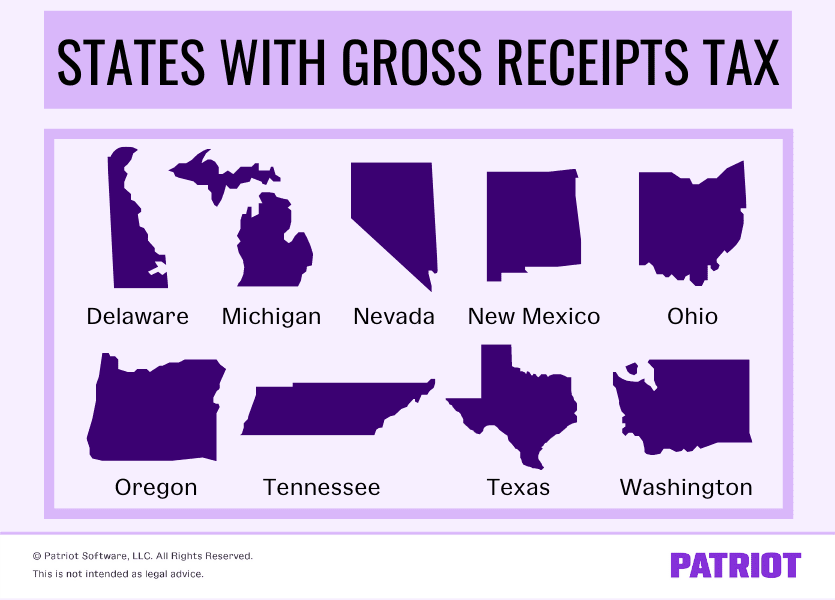

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Nevada Voters To Consider Economically Damaging Gross Receipts Style Tax A Type Only Five Other States Have Tax Foundation

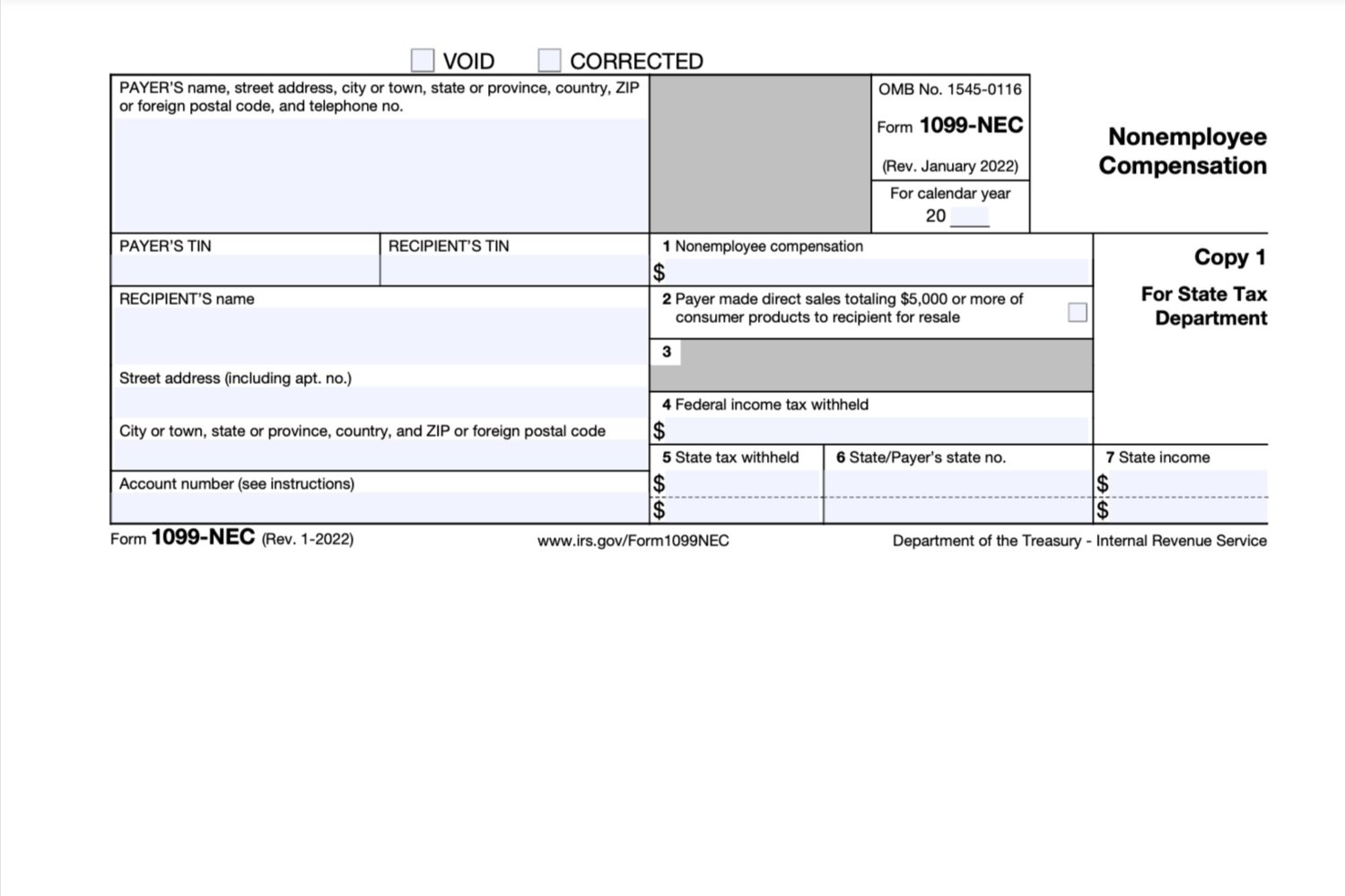

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

What Is Gross Receipts Tax Overview States With Grt More

San Francisco S Biggest Companies Now Forced To Pay A Homeless Tax

What Is Gross Receipts Tax Overview States With Grt More

San Francisco Taxes Filings Due February 28 2022 Pwc

2022 San Francisco Tax Deadlines

Wait How Would Louisiana S Gross Receipts Tax Work Tax Foundation

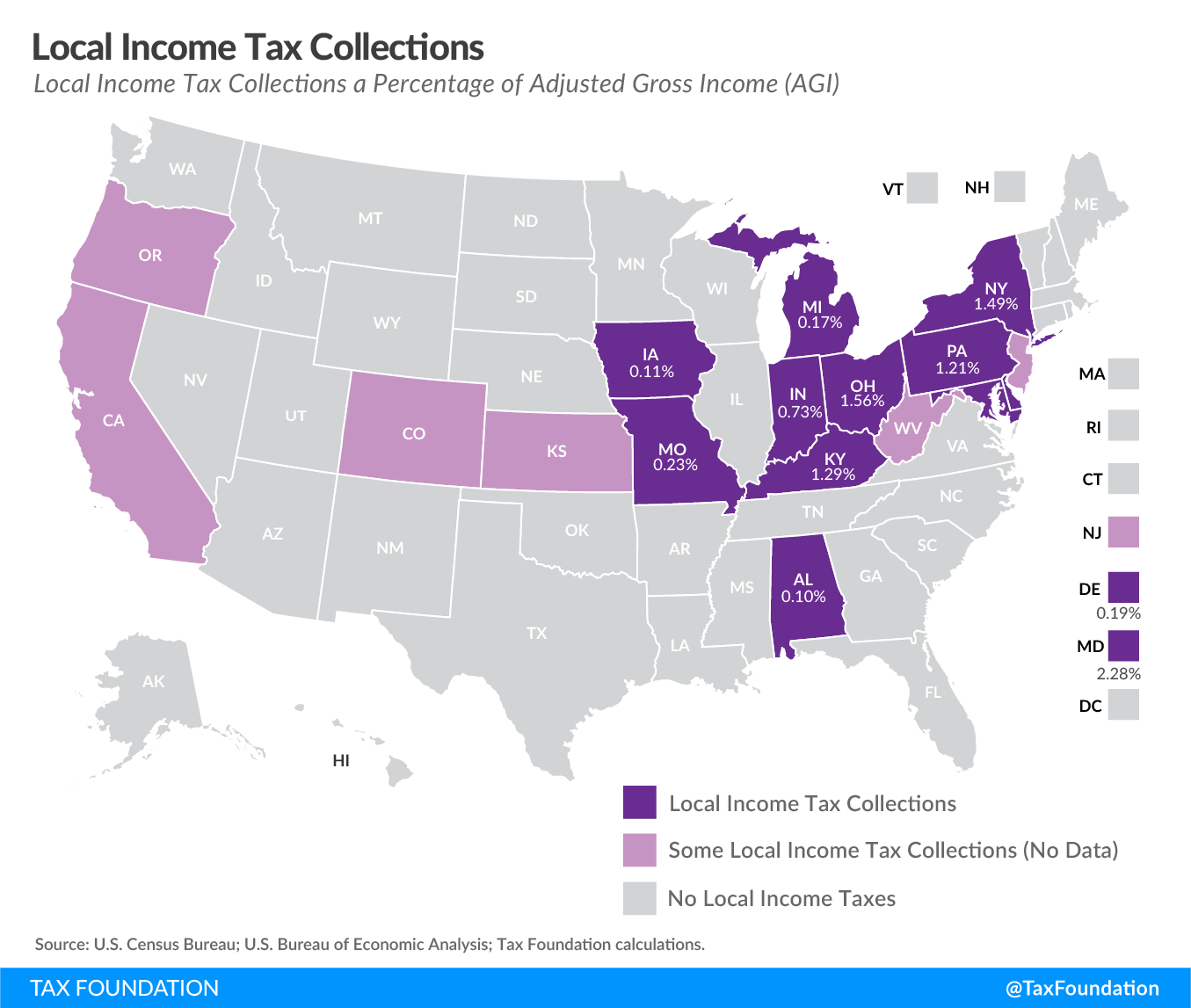

Local Income Taxes In 2019 Local Income Tax City County Level

Oregon S Gross Receipts Tax Proposal Would Increase Consumer Prices Tax Foundation

San Francisco Board Oks Credit For High Earner Business Tax Gift